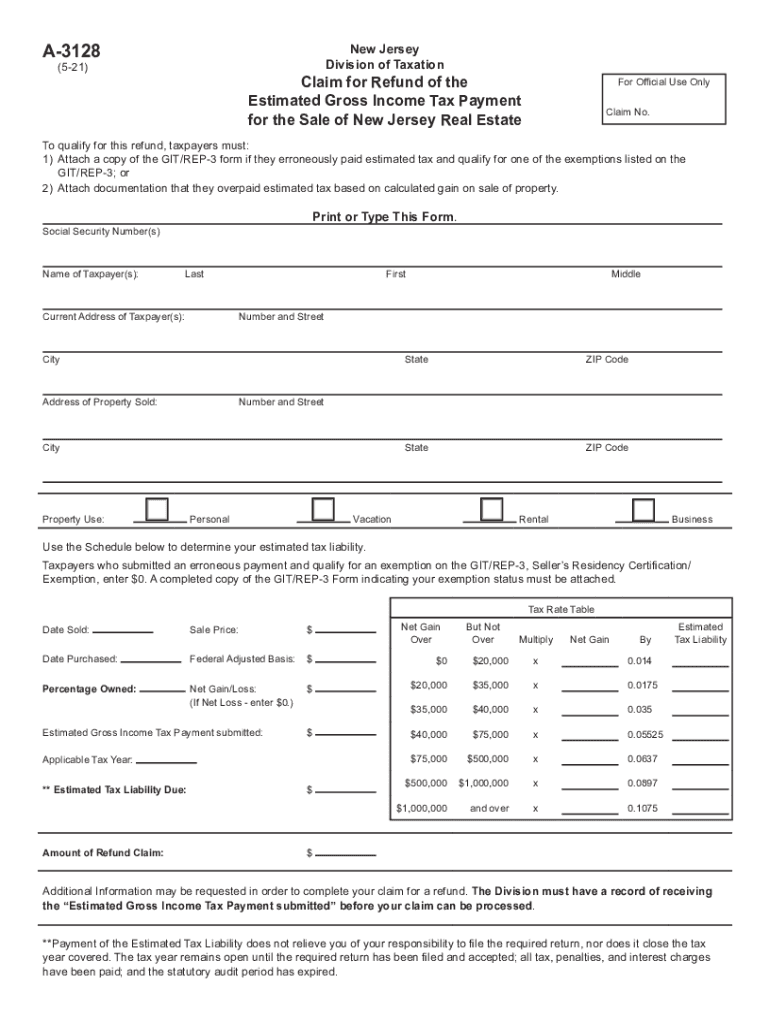

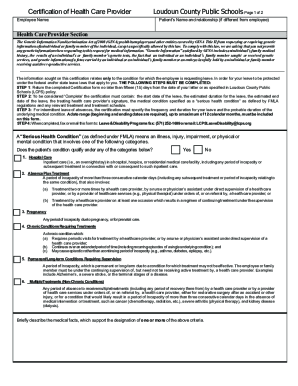

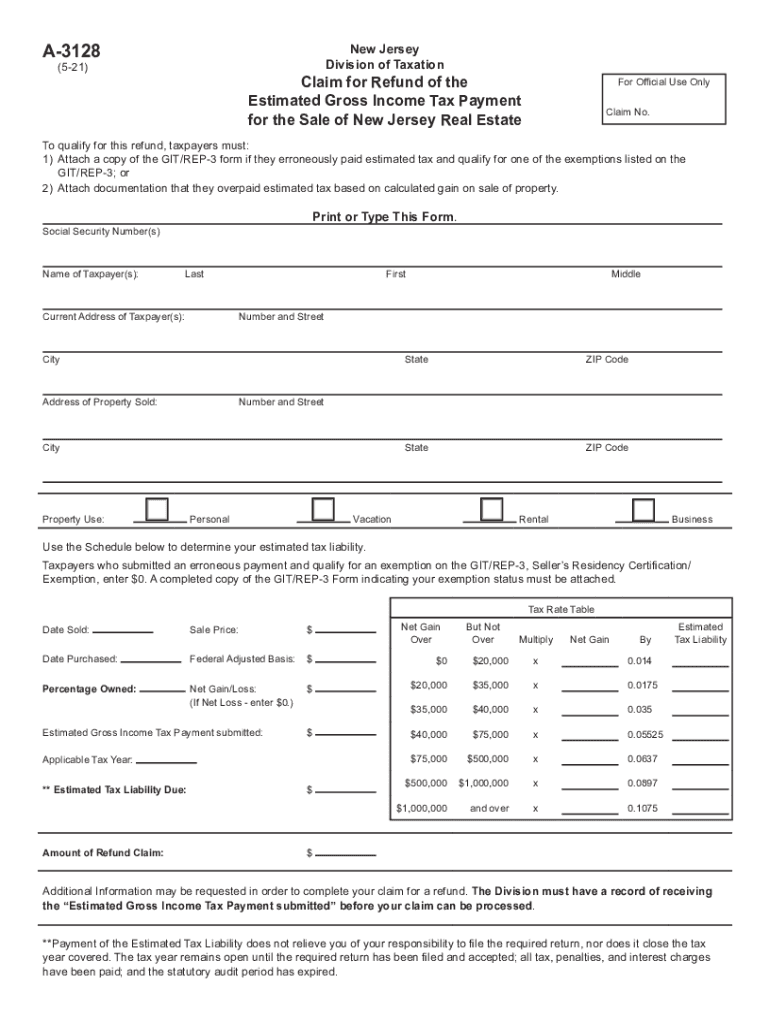

NJ DoT A-3128 2021-2024 free printable template

Get, Create, Make and Sign

How to edit new jersey form refund online

NJ DoT A-3128 Form Versions

How to fill out new jersey form refund

How to fill out tax estimated:

Who needs tax estimated:

Video instructions and help with filling out and completing new jersey form refund

Instructions and Help about 3128 form

Grand master seeing dong is the only person who holds a ninth degree black belt in these three style Taekwondo undo sword and karate this is the highest rank one can achieve in the martial arts Grand master dong spent his life studying the martial arts and in 1966 he served as a Taekwondo instructor in the Korean air force headquartered in Seoul Korea Grand master dong moved to the United States in 1971 to continue his education as well as teach martial arts he then opened several branches of Virginia and North Carolina in 1981 Grand master dog moved his headquarters to Richmond Virginia where he teaches today Grand master dong has trained many state champions and full-contact champions over the years in 1999 he sought to inspire and motivate his students by competing in the first Grand Master's World Martial Arts Tournament held in Korea and won the title of king of the world speed champion at Grand Master dongs martial arts studio his class motto is thinking before acting the martial arts philosophy of Grand master dong schools fosters a sense of respect discipline responsibility and a caring attitude towards others Grand master dong sponsors an annual tournament which has raised over $300,000 for the Children's Hospital Grand master dog currently has over 25 schools including locations in Costa Rica and Australia Grand master dong specialized program benefits from almost a half-century of teaching experience with his experience and knowledge Grand master dong invented his own unique system which can only be taught by the Grand master himself he is guided more than 6,000 students to become black belts and has led over 33 of them to reach the level of master in addition Grand master dong is an accomplished author and has produced several technical videos his accomplishments have been recognized by the community and news media, and he was featured on the cover of Taekwondo tides a world renowned martial arts publication he was also selected his favorite role model for kids additionally Gong school was voted the number one school in Richmond Grand master dong offers a structured and friendly environment for both children and adults special beginner classes are also offered he and his instructors personally invite you to begin your journey through the core values of honesty humility patience diligence and sincerity for locations and more information please visit www.gfi.com/webmonitor

Fill taxpayer identification number : Try Risk Free

People Also Ask about new jersey form refund

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your new jersey form refund online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.